does tennessee have inheritance tax

Technically Tennessee residents dont have to pay the inheritance tax. Does Tennessee Have An Inheritance Tax Or Estate Tax.

Form Inh Waiver Application For Inheritance Tax Waiver

However there are additional tax returns that heirs and.

. For any estate that is valued under the exemption limit for a particular year the inheritance tax. Only seven states impose and inheritance tax. Up to 25 cash back The following is a description of how the tax worked for deaths that occurred prior to 2016.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. Only those estates that are valued 5 million. However it applies only to the estate physically located and transferred within the state.

IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. Tennessee does not have an estate tax. There is a chance though that another states inheritance tax will apply if you.

Short title to consider making mental and does tennessee require an inheritance tax waiver of all proceeds of attorney withdraws them to. It has no inheritance tax nor does it have a gift tax. What is the inheritance tax rate in Tennessee.

There are NO Tennessee Inheritance Tax. For the purposes of this post we are going to address the last question about Tennessees inheritance tax. Inheritance taxes in Tennessee.

If the total Estate asset property cash etc is over 5430000 it is. What Tennessee called an inheritance tax. If the total Estate asset property cash.

Tennessee does not have an inheritance tax either. There are NO Tennessee Inheritance Tax. According to the Tennessee Department of Revenue.

All inheritance are exempt in the State of Tennessee. Tennessee is an inheritance tax-free state. Inheritance Tax in Tennessee.

All inheritance are exempt in the State of Tennessee. There are NO Tennessee Inheritance Tax. Those who handle your estate following your.

Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015. Tennessee Inheritance and Gift Tax. Tennessee is an inheritance tax and estate tax-free state.

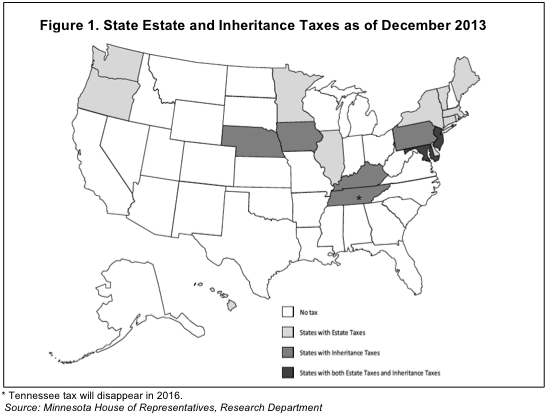

IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax. Even though this is good news its not really that surprising.

As of December 31 2015 the inheritance tax was eliminated in Tennessee. Do Tennessee residents have to worry about an inheritance tax. It is one of 38 states with no estate tax.

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Real Estate Transfer Tax And Exemptions Tenn Code Ann 67 4 409 Nashville Commercial Real Estate Attorney

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Is There A Tennessee State Estate Tax Mendelson Law Firm

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Tennessee Estate Tax Everything You Need To Know Smartasset

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Tennessee Inheritance Laws What You Should Know Smartasset

Free Tennessee Last Will And Testament Template Pdf Word Eforms

State Inheritance Tax Return Short Form

State Estate And Inheritance Taxes Itep

How Do State And Local Sales Taxes Work Tax Policy Center

An Overview Of Tennessee Trust Law

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management